Published Every Monday Since 2007 | Volume 909| April 22, 2024

THIS WEBSITE IS FOR SALE!

To buy email – contact@businessnewsforkids.com

YTD so far these many weeks markets were up (Bull picture shown), down (Bear picture), or draw (Bull/Bear picture) …

Bulls (Markets UP) =09 …

Bears (DOWN) = 06… and

Draw = 1

The market slide continues – the Nasdaq dropped close to 1,000 for the week.

- The DOW was down -89 points or -0.2%, the S&P 500 was down -182 points or -3.5%, and the Nasdaq was down -994 points or -6.1% for the week ending April 19th. Oil was down -$2.2 or -2.6% to $83.24 per barrel.

- There are multiple reasons for the market slide to continue –

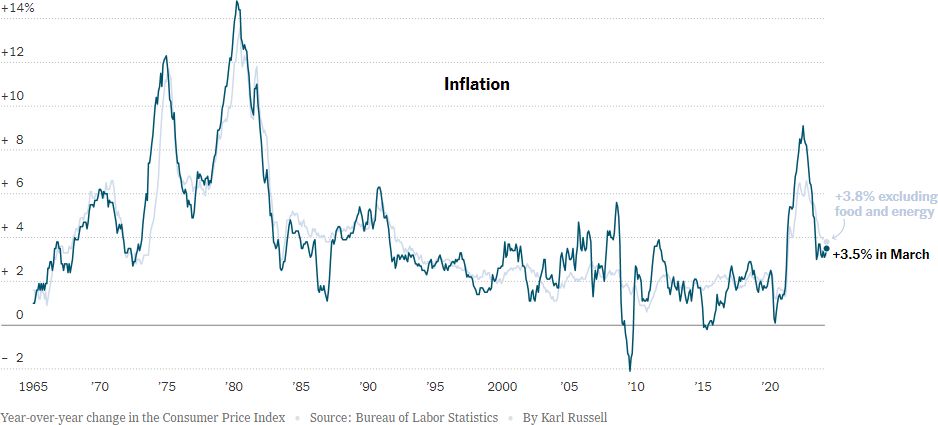

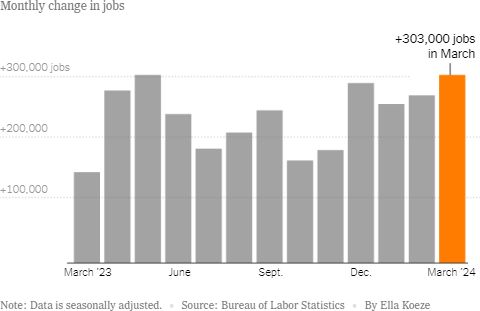

- First, a better-than-expected job report and a slight increase in inflation have repriced the Fed rate cut from three to just one in 2024, meaning that the interest rates are expected to stay higher for longer to keep the inflation in check. Until now, the inflation has been trending downward and getting close to the 2% Fed's mandate. Investors see the inflation increase as a sign that the Feds may delay the expected interest rate cuts which the investor community has been waiting to see happen sooner than later. Tech stocks especially get hit hard due to higher interest rates because they heavily invest in technologies and higher interest rates make it more expensive for them to borrow, hence the Nasdaq took some beating this week.

- Second, geopolitical tensions are higher, especially in the Middle East which could significantly impact the oil market and supply chain routes.

- Third, the S&P500 earning season is underway, and so far, most companies have posted better-than-expected positive financial results but their outlook is softer than before.

Inflation in March rises

March CPI (Consumer Price Index) or headline CPI or inflation came in at 3.5% (was 3.2% in Feb) year over year, above expectations. After stripping food and energy due to their volatility the inflation, called core inflation, was flat at 3.8% year over year, slightly higher than expectations. The core inflation is closely watched and tracked by the Federal Reserve policymakers due to its low volatility which is considered more reliable than the CPI.

What is Inflation?

Inflation is an increase in the general price level of goods and services over time. The U.S. Bureau of Labor Statistics calculates and tracks inflation yearly by the Consumer Price Index (CPI). The CPI is calculated by tracking the average price changes in relation to prices in a selected base year. CPI is a reliable estimate of inflation.

Inflation is caused when too much money is available for people to buy and there are too few goods and services to buy. Guess what happens in that case? Prices of goods and services will go up. In other words, goods and services will cost more. Inflation also reduces the value of money. For example, even if the salary of people goes up, they are not able to buy more goods and services (because the prices of these goods and services have gone up too!). With inflation, a dollar buys less and less over time.

Suppose you get $10 a week for doing chores around the house. You use this money to buy a ticket to watch the ball game for $6, a hotdog for $2, and a drink for $2. Over time, however, the ticket price of the ball game and food items rises. Now you can buy a ball game ticket for $7, and either a hotdog or a drink for $3. In this example, inflation caused the prices to rise and therefore, reduced the buying power of your $10. Perhaps you need to ask for a raise.

CPI (Consumer Price Index) or headline CPI or inflation, which is a measure of the average change over time in the prices paid by consumers for goods and services. Inflation has been going down. The Federal dual mandate of keeping full employment and inflation of 2%.

PCE (Personal Consumption Expenditure Price Index) –PCE number is closely watched by the Federal Reserve to assess inflation in the economy. PCE is a measure of the prices that people living in the US, or those buying on their behalf pay for goods and services. It is known for capturing inflation or deflation across a wide range of consumer expenses and changes in their behavior and is considered by the Federal Reserve as more

PPI (Producer Price Index) – PPI is wholesale price inflation at the producer level while CPI is the price inflation at the consumer level. PPI measures the average price change domestic producers receive for their output.

The US added 303,000 jobs in March, exceeding the forecast.

The U.S. Labor Department reported that in March 303,000 jobs were added, more than experts forecast. This was the 39th straight monthly gain! In 2023, the US created 3.1 million jobs and about 4.5 million jobs in 2022.

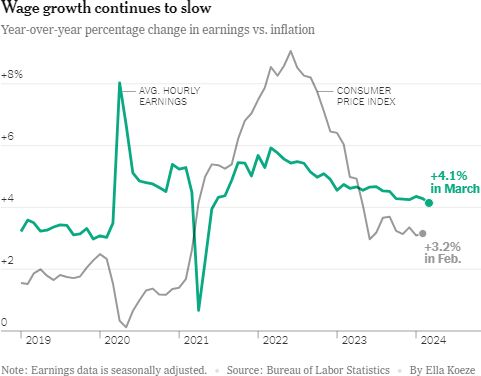

Source: NY Times

The unemployment rate fell to 3.8% from 3.9% in March. It is a key data that the Fed is watching to tame the inflation. The wages were up in March – average hourly wages rose 4.1% annually (4.3% in February; 4.5% in January).

Source: NY Times

The labor participation rate rose to 62.7% from 62.5% in March. Improvement in the labor participation rate can be seen as a sign that people are slowly coming back to the jobs they like, however. it is still below the pandemic level of 63.4%.

- In 2023 the US economy added 3.1 million jobs (In 2022, 4.5 million and in 2021 6.4 million jobs were added). 2020 was a massive job loss year. Pandemic-related job loss was 22 million. In comparison to 2019, the US added +2.1 million, 2018 added +2.7 million, and 2017 added +2.06 million jobs.

- The labor participation rate is 62.7%. Pre-covid this number was 63.4%. The participation is a percentage of 16 to 64-year-olds who are working or seeking employment. Non-working Americans include the retired, stay-at-home moms with kids, disabled, Seniors, College students AND those trying to find a job but have given up.

- Typically 300,000 new jobs a month are needed to drop the unemployment rate, and 150,000 jobs to keep up with the population growth.

Sources: Multiple, Bloomberg, CNBC, CNN, Yahoo Finance, Google, NY Times, BLS, US Government, CIA handbook,…Select other sources

Does it pay to study hard?

This time of the year close to 80 million students from nursery to college head back to school. Did you know that these millions of students and their parents will spend over $9 billion on clothes and $2 billion on books for getting ready for school?

Does it pay to get a college degree? The answer is most definitely, yes. According to the US Census Bureau, people with advanced degrees earned over $93,000 (median) in 2022/23 compared to over $75,000 with a Bachelor’s degree. People with a high school diploma earned $45,000 and people without a high school diploma earned about $36,000. In other words, people with advanced degrees earned 2.6 times as much as those with no education.

Does it pay to get a college degree? The answer is most definitely, yes. According to the US Census Bureau, people with advanced degrees earned over $93,000 (median) in 2022/23 compared to over $75,000 with a Bachelor’s degree. People with a high school diploma earned $45,000 and people without a high school diploma earned about $36,000. In other words, people with advanced degrees earned 2.6 times as much as those with no education.

How does money grow in a bank?

When you give your money to the bank, it uses that money to make more money. This allows the bank to give you something extra to keep you happy. It is like a cherry on top of your ice cream. The ice cream is your money and the cherry is what the bank gives you extra. This extra money is called interest.

How does a bank keep your money safe and still pay you interest? The Bank keeps some of your money at the bank and puts the rest to work. Suppose you deposit your $100 savings in your favorite bank which pays 3% interest. The Bank will take that $100 and loan it to someone who needs it, but not for free, at a much higher interest rate, say 10% because of the risk the bank takes – read below.

How does a bank keep your money safe and still pay you interest? The Bank keeps some of your money at the bank and puts the rest to work. Suppose you deposit your $100 savings in your favorite bank which pays 3% interest. The Bank will take that $100 and loan it to someone who needs it, but not for free, at a much higher interest rate, say 10% because of the risk the bank takes – read below.

First, the bank finds out why this person needs money and then checks this person’s credit history for his/her ability to repay the loan. The bank is trying to estimate what are the chances or risk of getting the money back. Second, if the chances or risks for repayment by this person are good then the bank gives (or lends) the money out to this person. When the bank lends the money, it acts as a money lender. The risk the bank takes requires something extra for its troubles, hence the higher interest. The person who needs money from the bank is called the borrower. The amount the person borrows is called the principal. The bank charges extra money on the principal. This extra money that the bank charges from the borrower is called the interest. In addition to the interest, the borrower has an obligation to return the principal in a fixed amount of time.

For a principal loan amount of $100, suppose the bank charges 10% interest or $10 interest from the borrower for a fixed time of say one year. The bank earns this $10, pays you some of it, say promised savings interest rate of 3% or $3, and keeps the remaining $7($10-#3) for itself. Not a bad deal! You see, the bank is also as smart as you are. When you deposit your money to the bank, it uses that money to make more money by charging more than it pays you and keeps the difference as its profit.

So now you and the borrower are happy. You are happy because you got interest on your savings and the borrower is happy because he/she got the money to do what he/she wanted to do, like buying a house, sending their kids to college, or buying a car. If the bank had not given the borrower the money he/she needed, the borrower would not have been able to do things he/she wanted to do.

Are you wondering why the bank gets to keep some money that the borrower pays as interest to the bank? After all, it was your money that the bank gave to the borrower. Well, the bank needs money to do its job: like finding borrowers, making sure that borrowers repay the loan, paying salaries to bank employees, paying for bank security, and many other things that businesses have to do. Banks also need to make some profit for their owners.

Sometimes, borrowers fail to repay the loan they took from the bank. Remember, that the bank still has to give you the interest of 3% that it promised to you, as well as return your savings ($100 that you deposited in the bank) whenever you ask for it. When borrowers fail to repay, the banks have to make good on their promise out of their pocket. It costs money to the bank. So they get to keep some money too.

What does $4.95 + tax means?

Let us say, you bought a gift for $4.95. But the cash register shows that you have to pay $5.25 (with 6% sales tax). What is that extra money you had to pay when you bought the gift? It is called sales tax and it is required to be paid by the consumer. State and local governments charge sales tax at the point of sale on retail goods and services. You, as a consumer pay the sales tax to the retailer, who passes it to the state and local governments.

Let us say, you bought a gift for $4.95. But the cash register shows that you have to pay $5.25 (with 6% sales tax). What is that extra money you had to pay when you bought the gift? It is called sales tax and it is required to be paid by the consumer. State and local governments charge sales tax at the point of sale on retail goods and services. You, as a consumer pay the sales tax to the retailer, who passes it to the state and local governments.

State and local governments set the tax level and decide on what percentage to charge on the selling price of the goods and services. The tax level and changes to the tax rate are hotly debated and voted on by elected officials and representatives. For example, among the 50 states, California has the highest sales tax of 7.25% (including 1% for the local government). The second highest at 7% are Mississippi, New Jersey, Rhode Island, and Tennessee. The lowest sales tax is 4% which is charged by Alabama, Georgia, Hawaii (only charges to the businesses and not to the consumer), Louisiana, New York, and Wyoming. There are five states, Alaska, Delaware, Montana, New Hampshire, and Oregon, with no sales tax. Most of the states do not charge sales tax on food items. There is no national level sales tax. In the 19th century, several states started to charge some sort of tax. However, West Virginia, in 1921, was the first state to charge sales tax as we see it today. Since then, other states started to impose the sales tax and continue to do so until today.

Why do state and local governments charge sales tax? Taxes are a major source of income for the state and local governments. For example, besides sales tax, other taxes such as state income tax and real estate tax provide a good source of income for the governments. The collected taxes by the state and local governments help to pay for key services, such as police, 911 service, fire stations, emergency services, building and maintenance of roads, bridges and public parks, and many more important services that we rely on and use frequently.

Who are the CEO, CFO, Shareholders, and the Board of Directors? What is SOX?

You read in the news about the CEO, CFO, and Directors, but who are they and what do they do?

CEO stands for Chief Executive Officer and is a top-ranking corporate position, responsible for overseeing company operations. The CEO is often the company’s President and reports to the board of directors. He or she is the most important person in the company and is responsible for its financial results, health and future.

CFO stands for Chief Financial Officer. The CFO is the person responsible for financial planning, record-keeping, reporting financial performance and forecasts to the investors. The CFO typically reports to the CEO and is frequently a member of the board of directors. Shareholders of a company are the ultimate owners of a company.

Shareholders elect members of the board of directors to govern a company on their behalf. Members of the board report to shareholders. Duties of the board of directors include supervising the work of the CEO and the company. They hire the CEO and assess the CEO’s performance on goals and strategies that are set for the company. Members of the board of directors have the authority to fire the CEO as well.

SOX is a short form for the Sarbanes-Oxley Act. The Sarbanes-Oxley Act is a federal law signed on July 30, 2002, that establishes higher requirements for truthful and accurate financial reporting standards by all public companies. This law is named after Senator Paul Sarbanes of Maryland and House Representative Michael Oxley of Ohio. Sarbanes-Oxley Act contains 11 major sections that define new corporate board responsibilities with provisions for criminal penalties for not following the law. The SOX imposes higher reporting standards and responsibilities on a company’s board of directors, its management, and its auditors.

This law was in response to major corporate and accounting scandals at companies like Enron, Tyco, WorldCom, and many more causing public mistrust in accounting and reporting. Many hard-working people lost their jobs, savings, and investments in these companies because of greed and corrupt management, board and accountants. Some of the people responsible for the scandals are in US jails.

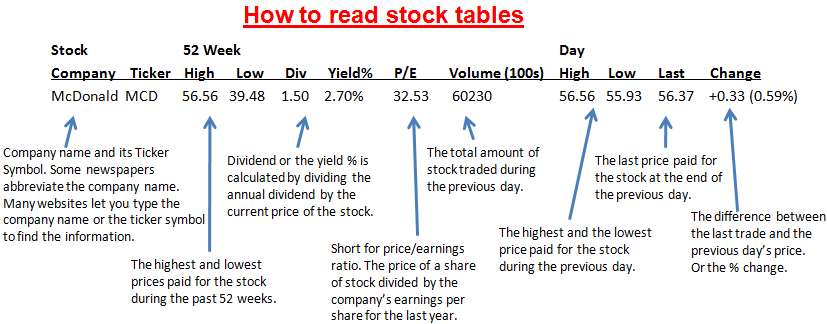

How to read stock information?

Stock information is provided by various newspapers, magazines, and websites. Any national or regional newspaper with a business section will have the stock information. Popular sources are the Wall Street Journal, Financial Times, New York Times, USA Today, major city newspapers like LA Times, Chicago Tribune, and your local newspaper. You can also go to stock exchange websites, Yahoo Finance, CNN Money, WSJ.com and many more to check on your favorite stocks. There are about 15,000 publicly traded US stocks that are tracked and organized by alphabetic order to help you find stock information easily. The stocks are listed by their stock exchanges. There are three major US stock exchanges – the first and the largest is the New York Stock Exchange Composite or NYSE, the second largest is NASDAQ, and the third is the American Stock Exchange or AMEX. One way to remember the difference is that NYSE and AMEX stock tickers are three letters and NASDAQ tickers are four letters. Other important stock exchanges include FTSE100 in the UK, DJ Euro Stoxx in Europe, Nikkei Stock Average in Tokyo (Japan), Straits Times in Singapore, Hang Seng, in Hong Kong, and Bombay Sensex in Bombay (India). The stock information is easy to read once you understand how to read it. We will take McDonald’s company as an example to walk you through the process of reading the stock information. Let us get started. You need to know the company name or the ticker symbol of the company. In our case, the company name is McDonald’s and its ticker symbol is MCD. Newspapers will show you the information organized by columns. Each column header name will tell you what this column information means. Due to space limitations, you will see that the information is sometimes abbreviated or coded to simplify. We have split the columns into “Easy and quick read columns” and “Advanced reading columns”. For beginners, we suggest that you first focus on the “Easy and quick read columns”. Once you get comfortable with the information you can start to read the other columns. Also, see “How to read stock tables” below. |

|

Easy and quick-read columnsTicker Symbol or SYM – Ticker Symbol is a unique set of alphabetic letters that identify a company’s stock. In short, it is also referred to as just Ticker. For example, McDonald’s ticker symbol is ‘MCD’, and Walt Disney’s ticker symbol is ‘DIS’. Ticker symbols are used to buy or sell the company stocks on the stock exchange. You will also see the ticker symbols in the financial news. Company Name or STOCK – This column lists the name of the company. Where the company name is larger than the column space, then the company name is abbreviated to a meaningful level. For example, United Parcel Service could become UtdParcel. Bid/Ask – When you buy the stock you pay the Ask price (the higher price) and when you’re selling your stock you receive the Bid price (the lower price). Close or Last – The close is the last trading price recorded when the market closed on the day. If the closing price changes by more than 5% up or down from the previous day’s close, the entire listing for that stock is bold-faced. MCD closed on Oct 5th, 2007 at $56.37. Net Change or Change or CHG – This is the dollar amount change in the stock price from the previous day’s closing price. When you hear about a stock being “up for the day,” it means the net change was positive from yesterday. MCD Net Change from Oct 4th to Oct 5th is +0.33 or +0.59%. |

|

Advance reading columnsYear-to-date % change or YTD % CHG – This means how much the stock price changed since the beginning of the year. For example, we have been tracking MCD stock since the beginning of the year and the % change in the stock price is over +28% year to date as of this week ending October 5th, 2007. 52-Week High and Low or 52 Hi-Lo – These are the highest and lowest prices at which a stock has been bought or sold over the previous 52 weeks (for one year). Sometimes you will see an arrow or a special mark to show if this stock price is at a new 52-week low or high. MCD’s 52-week High and Low are $56.56 and $39.48. Day High and Low or Day Hi-Lo– This indicates the price range at which the stock has traded throughout the day. In other words, these are the maximum and the minimum prices that people have paid for the stock. MCD Day High and Low is $56.56 – $55.93. Trading Volume, Volume, or Vol. – This figure shows the total number of shares traded for the day, listed in hundreds. To get the actual number traded, add “00” to the end of the number listed. High volume means this stock is widely owned or that there is important news about the company that investors want to take advantage of by selling or buying the stock. You will also notice that large and famous companies typically have larger trade volumes. Above-average trading situations show out-of-normal trading activity that as an investor is important to decide if it is good or bad for the stock. Underlined or bold stock information means large volume change, compared to this stock’s average trading volume. MCD trading volume for the day is 6 million and the average is over 8 million. Type of stock – You may see a special symbol after the company name for the ticker symbol, such as, ‘pf’. ‘Pf” means preferred stock and no symbol means it is a common stock. We will cover Common Stock and Preferred Stocks in our later issues. Dividend Per Share, Dividend Yield, or YLD – This indicates the annual dividend payment per share and is shown as a percentage of price. It is calculated as annual dividends per share divided by price per share. If this space is blank, the company does not currently pay out dividends. As of Oct 5th, 2007, MCD’s dividend yield is $1.5 or 2.7%. Price/Earnings Ratio, P/E, or PE – This is calculated by dividing the current stock price by earnings per share from the last four quarters. MCD P/E as of Oct 5th, 2007 is 32.53. What P/E means, will be discussed in our later issues. Each paper has its codes to show specific stock information, and you should take time to read their descriptions. For example, the Wall Street Journal has “How to read the stock tables” that tells you what the abbreviation and sign mean. |

What is “Black Monday”… ”Crash of 87”?

Thirty-six years ago, on October 19th, 1987, the Dow lost 22.6% in one day or 508 points, based on the Dow’s level at that time. This day is known as the “Black Monday” or “Crash of 87”. The term Black Monday is also applied to the Dow’s drop on Monday, October 28, 1929, which started the stock market crash of 1929.

October 19th, 1987 was the worst one-day point drop ever for the Dow at the time and remains the second largest percentage point drop in the entire history of the Dow. At today’s levels, this percentage drop will be equivalent to a 3,200 points loss in one day!

Many experts believe that the 1987 crash was caused by many things. For example, computer trading systems were not mature enough to handle the massive selling by the investors. Overpriced stock markets and uncertain economic conditions added to the nervousness of investors. No one knew what was going on in the stock market which made more people nervous and panic selling continued. It is interesting to note that within two days, by October 21, 1987, the Dow had regained about 290 points. In fact, October 21, 1987, is the single largest one-day percentage increase (10.15%) since 1933.

Since Black Monday, many changes have been made to improve the stock trading computers and the process. Can it still happen? Possibly.

What is APR?

When you borrow money from a bank or any other lender, you have to pay back the borrowed amount and also interest on top of that. All these payments have to be made within the agreed upon time period. We can think of interest as the cost of borrowing.

Suppose you need $1,100 for one year, and your bank offers to lend you and charges 7% interest. But is that the true interest rate? Not if the bank is asking for some fees, like application fee or credit report fee etc. In that case, your true interest rate will turn out to be higher than the 7% that the bank offered. All lenders are required by law to inform the borrower of the “Annualized Percentage Rate,” also known as APR. APR is a better indicator of what interest rate you are paying on the loan.

In the example above, the interest payments for the year will be 7% x 1,100 = $77. However, suppose that to get the loan you had to also pay a non-refundable application fee of $100. What is your APR?

To understand APR, determine the net amount of cash you get from the bank. You got $1,100, the amount you borrowed, but paid back $100 in application fee. So the net cash you got was $1,000 (=$1,100 – $100). However, you still have to pay $77 in interest. So what is the true interest you are paying? It is 7.7%, calculated as $77 (your interest payment)/ $1,000 (the net cash). The APR for your loan will be 7.7%. The higher the fees, the higher will be the APR.

In this example, we assumed that the loan period was one year. If the loan period is more than one year, then APR will be less than 7.7%, but still more than 7%. So next time you borrow money, make sure to ask for APR.

Why is consumer confidence so important?

Consumer confidence is important, because, if people feel less confident about their future, jobs, and economy, they will want to spend less money and less buy goods. When people do not buy goods, then businesses cannot sell what they make. Businesses soon start to reduce the number of people they need. Soon unemployment starts to increase. When people lose their jobs it makes it difficult to pay for the mortgages, and therefore, it would make the housing problem worse. This starts a cycle that is not good for the people, the housing market, and the economy. Consumer spending consistently accounts for about 70% of the US economy which is why most experts watch consumer spending and their outlook on spending very closely. The US consumers spent over 17 trillion dollars on goods and services in 2022.

Consumer confidence is important, because, if people feel less confident about their future, jobs, and economy, they will want to spend less money and less buy goods. When people do not buy goods, then businesses cannot sell what they make. Businesses soon start to reduce the number of people they need. Soon unemployment starts to increase. When people lose their jobs it makes it difficult to pay for the mortgages, and therefore, it would make the housing problem worse. This starts a cycle that is not good for the people, the housing market, and the economy. Consumer spending consistently accounts for about 70% of the US economy which is why most experts watch consumer spending and their outlook on spending very closely. The US consumers spent over 17 trillion dollars on goods and services in 2022.

**********************************************************

How to be financially strong? Start early, and now!

We are starting this section as a running blog to educate you about key and simple things one can do now to become financially stable, and over time become a millionaire!

These are easy things to learn, such as, managing your costs, saving money, long-term investment with the power of compounding, and many more topics. The idea is that educating yourself about these topics can give you a head start to shape your future – our motto – Today Shapes Tomorrow!

- In 2024 the DOW is +0.8%, the S&P500 is +4.1% and the NASDAQ is +1.8%

- In 2023 the DOW was 13.7%, the S&P500 was +24.2% and the NASDAQ was +43.4%

- In 2022 the DOW was -8.8%, the S&P500 was -19.4% and the NASDAQ was -33.1%

- In 2021 the DOW was up +18.7%, the S&P500 +26.9% and the NASDAQ +21.4%

- In 2020 the DOW was up +7.2%, the S&P500 UP+16.3% and the NASDAQ UP +43.6%

- In 2019 the DOW was up +22.3%, the S&P500 up +28.9% and the NASDAQ up +35.2%

- In 2018 the DOW was down -6.7%, the S&P500 down -7.0% and NASDAQ down -4.6%.

- In 2017 the DOW was up 25.1%, the S&P500 up 19.4% and the NASDAQ up 28.2%

Copyright © 2007 – 2021 BusinessNewsForKids.com

Black Monday?

Black Monday? What is a Tariff?

What is a Tariff? Great Depression vs. Recession of 08'

Great Depression vs. Recession of 08' How do businesses raise money?

How do businesses raise money? Depression vs. Recession

Depression vs. Recession Emigration in the U.S.?

Emigration in the U.S.? Consumer Price Index and Producer Price Index?

Consumer Price Index and Producer Price Index? Is Full Employment Good?

Is Full Employment Good? What is sales tax?

What is sales tax? Mergers and Acquisitions?

Mergers and Acquisitions? What is inflation?

What is inflation? What is a credit score?

What is a credit score? Buying back shares?

Buying back shares? Basics of the Economy

Basics of the Economy Does Studying Pay Off?

Does Studying Pay Off? Supply and Demand

Supply and Demand What is the Currency and Foreign Currency Exchange rate?

What is the Currency and Foreign Currency Exchange rate?  Quantitative Easing?

Quantitative Easing? What is a stronger or a weaker currency?

What is a stronger or a weaker currency? Working and Unemployed?

Working and Unemployed? What does the dollar slide mean?

What does the dollar slide mean? Bank Loans and 2008

Bank Loans and 2008

Fed Tapering of Q.E.

Fed Tapering of Q.E. New Federal Reserve Chair

New Federal Reserve Chair 1st Woman Fed Reserve Chair

1st Woman Fed Reserve Chair